Our Mission

Provide accessible, fair, and responsible loans and support to Arizona nonprofits and economically underserved small businesses outside the economic mainstream.

Since becoming a CDFI in 2018, Growth Partners Arizona has focused on providing accessible, fair, and responsible loans and support to Arizona nonprofits and small businesses. To celebrate our recent accomplishments, we are highlighting the stories that captures our work and impact over the last few years.

“Thank you for being a vital part of this journey. We look forward to continuing this work—together. Rest assured, our commitment to you and our shared goals remain steadfast.”

Transformational Impact & Growth

Deployed to small businesses and nonprofit organizations through direct loans, alternative lending, grants, sponsorship, and investments since 2012.

In Direct Lending to 156 Borrowers

Through our lending programs, we’ve delivered responsible, affordable capital to small businesses (44%) and nonprofits (56%), with 91% of borrowers located in our target market—driving economic growth and community revitalization where it’s needed most.

In Alternative Lending to 103 Borrowers

We work with partners to expand access to fair financing for those most vulnerable to predatory lending. Among these borrowers, 81% faced significant barriers to traditional capital, and 94% received technical assistance..

Reflecting with Gratitude (FY18 - FY22)

Looking Back

The Nonprofit Loan Fund was founded in 2012 by Helaine Levy of the Diamond Foundation, Clint Mabie of Community Foundation for Southern Arizona, and Tony Penn of the United Way of Tucson and Southern Arizona. In 2018 the executive leadership team made the decision to pursue CDFI Certification. This decision helped to establish the foundation for the work we do today.

Financial Snapshot

Fiscal Year End 2022

$1.15M in Outstanding Loans

$3.44M Total Assets

Following its designation as a Community Development Financial Institution (CDFI) in 2018, the Nonprofit Loan Fund rebranded as Growth Partners Arizona and expanded its mission to include small business lending. Between 2018 and 2022, we deployed nearly $3 million in direct loans and facilitated an additional $325,000 in Kiva microloans—delivering essential capital to businesses in Southern Arizona.

By the close of fiscal year 2022, our outstanding loan portfolio totaled $1.15 million, with total assets reaching $3.44 million. These milestones reflect both the strength of our financial stewardship and the resilience of the businesses and organizations we proudly support.

Understanding Our Limitations

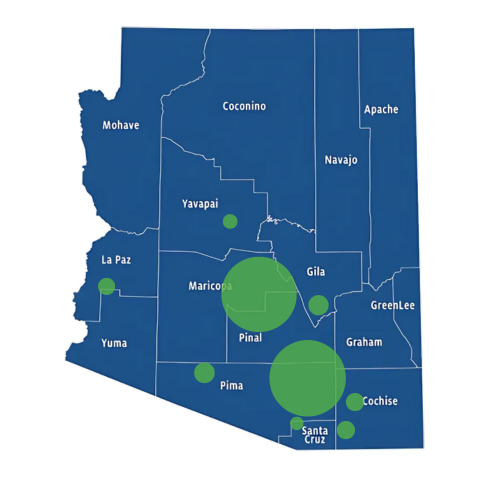

While our work was making a real difference, the path to greater impact exposed critical constraints. Lending remained concentrated in a few regions, our program offerings were limited, and our infrastructure lacked the capacity to scale. It became clear – meaningful growth would require a bold and strategic expansion.

The Path Forward

Expanding Our Reach & Impact

In January 2023, Growth Partners Arizona initiated a two-year strategic plan to expand its impact as a statewide CDFI. Guided by a clear vision, we embarked on a mission to strengthen partnerships, broaden access to capital, and enhance measurable outcomes across Arizona.

Our work over the last two years has been guided by three priorities:

Growing Intentionally through Partnerships & Collaboration

Launching the Growth Lending Model

Strengthening Outcomes & Amplifying Impact

“Our partnership with Growth Partners Arizona reflects our shared commitment to fostering economic growth and prosperity in Northern Arizona. We believe that by working together, we can make a meaningful difference in the lives of underserved communities by providing them with the resources they need to thrive.”

-Scott Hathcock, President & CEO at Moonshot AZ

Priority One

Grow Intentionally Through Partnerships & Collaboration

Key Accomplishments

Expanded Geographic Reach – We established a presence in Phoenix, Flagstaff, and Tucson, ensuring closer engagement with local entrepreneurs and nonprofits.

Strengthened Partnerships – We worked with local nonprofits to support small business programs and expand capital access in key areas throughout the state.

Selected as Arizona Microbusiness Loan Program Partner – As a key lending partner for Arizona’s Microbusiness Loan Program we are expanding our ability to serve small businesses across multiple rural counties.

Featured Client

Transforming Lives Through Impact Investments

Since 2020 we have supported the Televerde Foundation PATHS programs. These programs help currently and formerly incarcerated women Prepare, Achieve, and Transform for Healthy Success.

980

Women participated in PATHS Programs

650 women have graduated, with 95% securing jobs within 45 days at an average salary of $45K. Recidivism remains under 1%.

Priority Two

Launch Our Growth Lending Model

Key Accomplishments

Diversified Loan Offerings – We grew from two to eight lending programs, which now includes alternative, collateralized, and character-based lending solutions.

Kiva Tucson Hub Expansion – Our Kiva Tucson Hub has assisted in providing nearly 100 small businesses with access to nearly $1M in kiva loans.

Managed Loan Funds – We partnered with the City of Avondale, the City of Tucson, and Cochise County to launch our Managed Loan Fund program allowing us to manage nearly $2.6M in alternative and environmental lending. This not only expanded our lending capacity but also created additional revenue streams.

“On average, low income small business owners are paying as much as 30% more on their utility bills, largely because they’re running outdated equipment. The Green Loan Fund enables them to upgrade equipment and experience significant savings. Our innovative approach, in partnership with Growth Partners AZ, is to base their ability to repay on that monthly savings- so we don’t disrupt their cash flow.”

- Jason, Director of Sustainability Initiatives, Local First Arizona

Our Moments of Impact Series allow us to amplify the stories of our borrowers, partners, and strategic initiatives. This video highlights the impact of our Kiva program which has deployed nearly $1M in loans to small businesses in Southern Arizona.

Priority Three

Strengthen Outcomes & Amplify Impact

Key Accomplishments

Launched the Innovative Solutions – Through key strategic investments we launched Arizona’s first statewide financial education and access to capital platform.

Digital Transformation in Lending – We implemented modern lending platforms and automation tools, making our loan process faster, more efficient, and more accessible.

Enhanced Storytelling & Impact Measurement – Our “Moments of Impact” initiative highlighted real borrower success stories, demonstrating the human impact of our work.

Organizational Impact

FY22 - FY24 Impact

$3,314,491

Facilitated to local businesses and nonprofits over the last two years.

We reached nearly 500 clients, provided over 700 hours of direct support, and 92% of our clients are located in our CDFI target market.

Direct Lending

$2,227,991

Alternative Lending

$811,500

Grants, Scholarships, or In-Kind

$275,000

Financial Snapshot

December 2024

$2.5M in Outstanding Loans

$5.1M Total Assets

In FY24, Growth Partners Arizona had a record year in direct lending, boosting program revenue and surpassing $2 million in outstanding loans for the first time.

We also reduced reliance on government grants—from 60% to under 11%—by forming strategic partnerships with local financial institutions.

Since 2022, total assets have grown by 48%, and our loan portfolio has expanded by 113%, reflecting strong growth and deeper community reach.

Next Steps in Driving Economic Mobility

Building on our success and the launch of our GrowthHUUB platform, we are committed to expanding its reach and functionality to ensure that more entrepreneurs, and business owners have access to financial education, business resources, and capital connections. By leveraging innovative technology, we will enhance GrowthHUUB’s digital learning experience, expand its statewide reach, and integrate new tools to help businesses navigate lending and financial planning.

Recognizing that nonprofits play a crucial role in Arizona’s economic landscape, we are also developing a Nonprofit Finance Education Solution to address the unique financial challenges nonprofit leaders face.

Next Steps in Driving Economic Mobility

Building on our success and the launch of our GrowthHUUB platform, we are committed to expanding its reach and functionality to ensure that more entrepreneurs, and business owners have access to financial education, business resources, and capital connections. By leveraging innovative technology, we will enhance GrowthHUUB’s digital learning experience, expand its statewide reach, and integrate new tools to help businesses navigate lending and financial planning.

Recognizing that nonprofits play a crucial role in Arizona’s economic landscape, we are also developing a Nonprofit Finance Education Solution to address the unique financial challenges nonprofit leaders face.

The future of Growth Partners Arizona is rooted in collaborative leadership and strategic alignment. By working with our investors, partners, community leaders, stakeholders, and borrowers, we are positioned to create lasting economic impact, drive innovation in financial services, and build a more resilient and prosperous Arizona.